florida estate tax exemption 2021

This means that when someone dies and. Form 4768 Application for Extension of Time to File a Return andor Pay US.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Title XIV TAXATION AND FINANCE.

. Get Access to the Largest Online Library of Legal Forms for Any State. On May 21 2021 in News Releases by Staff. Citizen the Florida estate tax exemption amount is still 114 million.

The Department reviews each exemption certificate sixty 60 days before the current certificate expires. For those governmental entities located outside Florida. Lets not forget my favorite annual amount announcement - for calendar year 2022 the tax imposed under 4161 b 2 A on the first sale by the manufacturer producer or importer of any shaft of a type used in.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. As a result of recent tax law changes only those who die in 2019 with estates equal to or greater than 114 million must pay the federal estate tax. Will provide over 168 million in savings for families and businesses.

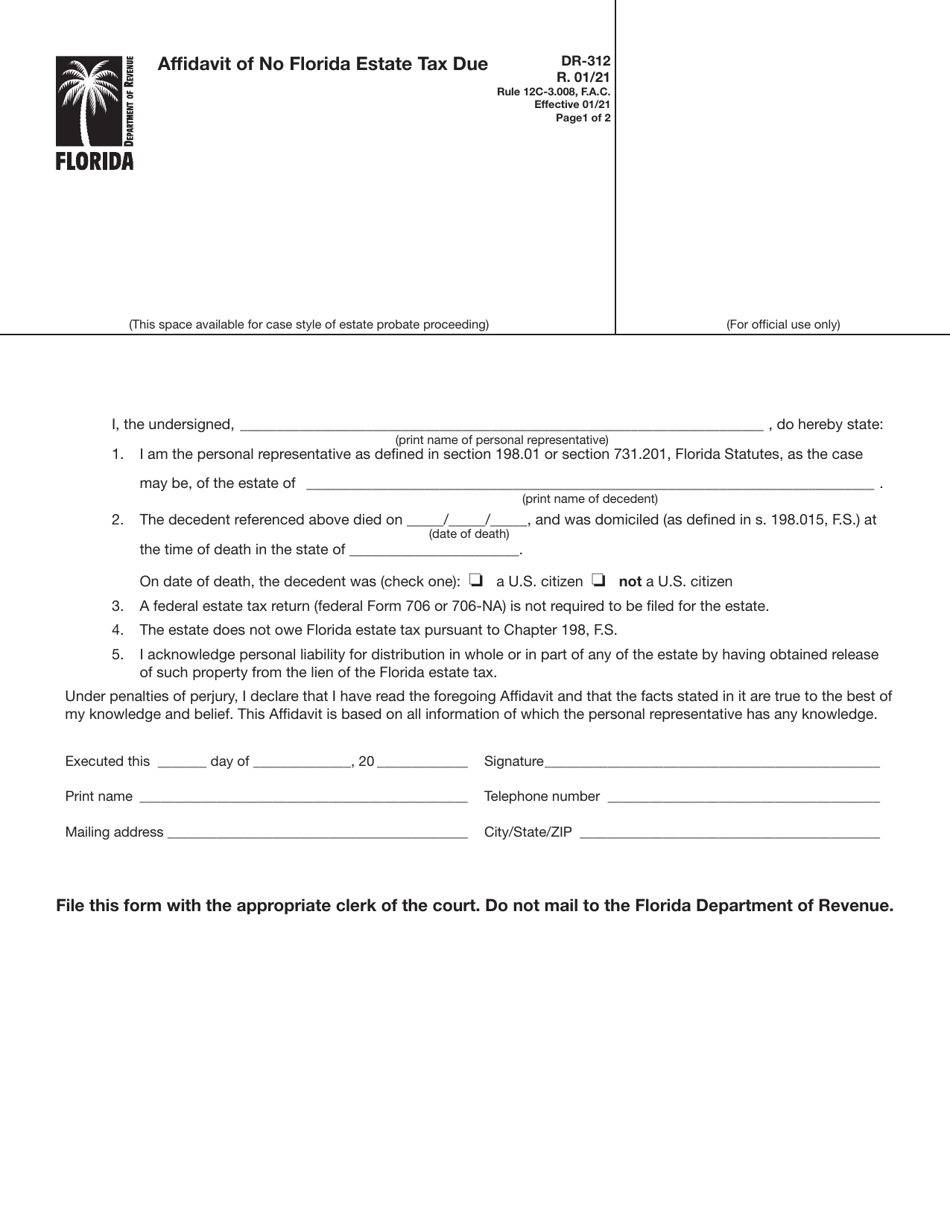

No Florida estate tax is due for decedents who died on or after January 1 2005. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due Florida Form DR-312 to release the Florida estate tax lien. Proposal 2 Limitation on Lifetime Gifting.

Ad valorem tax exemptions for historic properties. If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. 2022 EstateGiftGST Exemption - increased to 1206 million from 117 million.

The Form 706-NA United States Estate and Generation-Skipping Transfer Tax Return Estate of nonresident not a citizen of the United States if required must be filed within 9 months after the date of death unless an extension of time to file was granted. Even if youre a US. The estate tax exemption in 2021 is 11500000.

Today Governor Ron DeSantis signed into law House Bill 7061 Floridas Tax Cut Package to ensure our state remains one of the most tax-friendly environments in the nation. 2021 Florida Sales Tax Commercial Rent December 30 2020. A lesser-known additional homestead exemption will allow an ADDITIONAL 2500000 - 5000000 to be deducted from the propertys assessedtaxable value.

The tax cuts and jobs act raised the lifetime gift and estate tax exemption to 117 million for 2021 and 1206 million in 2022. Except as otherwise expressly provided in this act this act shall take effect July 1 2021 Last Action. The 2021 Florida Statutes.

Bob Hodge Realtor 500 N Westshore Blvd Ste 850 Tampa FL 33609 Office Phone. The amount of the estate tax exemption for 2022. But once you begin providing gifts worth more than the applicable annual limit to any individual in a.

Additional ad valorem tax exemptions for historic properties open to the public. Governor DeSantis Signs Floridas Tax Cut Package. The District of Columbia moved in the opposite direction lowering its estate tax exemption from 58 million to 4 million in 2021 but simultaneously dropping its bottom rate from 12 to 112 percent.

813 286-6563 Cell Phone. Florida estate tax exemption 2021 Thursday March 10 2022 Edit. Property subject to taxation.

813 245-1157 Real estate agents affiliated with Coldwell Banker are independent contractor sales associates and are not employees of the company. Most Realtors know about the 50000 standard homestead exemption but did you know that there are around two dozen other exemptions. In order to qualify for this additional homestead exemption you must first qualify for the first homestead exemption discussed above.

The Tax Cuts and Jobs Act raised the lifetime gift and estate tax exemption to 117 million for 2021 and 1206 million in 2022. Proposal 1 A reduction in exemptions. The gift tax annual exclusion remained the same between 2019 and 2021.

If your estate is worth less than this youll need to pay the federal income tax as well as any possible federal income taxes. When a Florida governmental entity remains in effect a new exemption certificate will be mailed to the governmental entity. Florida Estate Tax Rules On Estate Inheritance Taxes Fl Dor Dr 312 2021 2022 Fill Out Tax Template Online Us Legal Forms Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg.

Sales tax exemption certificates expire after five years. 5242021 - Chapter No. Extending the expiration date of the sales tax exemption for data center property.

An individuals leftover estate tax exemption may be transferred to the surviving spouse after the first spouses death. Presently the tax exemptions are set at 11700000 per person an increase from 2020s exemption of 11580000. Citizen Spouse - increased to 164000.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. 2022 Annual Exclusion Gift to non-US. The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year.

This exemption is already set to be cut in half in December of 2025. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. Jabil was the second and received a 100000 exemption per year for five years in August.

For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. This exemption is up from 159000 in 2021. Given that Florida has around a 2 average tax rate that means a homeowner with 500000 in portability will see a tax bill about 10000 a year lower than it would be without it.

Then you have to be age 65 or older. Using the 2021 current exemption of us117 million for 2021 and the current estate tax rates the potential estate 1 2022 the corporate tax. Starting in 2022 the exclusion amount will increase annually based on.

The current proposal is set to reduce the exemption to 3500000. If youre a Florida resident and the total value of your estate.

Florida Estate Planning Complete Overview Alper Law

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Florida Estate Planning Guide Everything You Need To Know

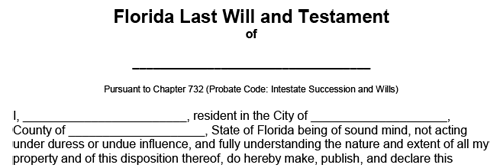

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

U S Estate Tax For Canadians Manulife Investment Management

Florida Inheritance Tax Beginner S Guide Alper Law

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

U S Estate Tax For Canadians Manulife Investment Management

Florida Estate Tax Rules On Estate Inheritance Taxes

U S Estate Tax For Canadians Manulife Investment Management

Florida Inheritance Tax Beginner S Guide Alper Law

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Florida Attorney For Federal Estate Taxes Karp Law Firm

Florida Property Tax H R Block

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller